Women’s financial inclusion is a top priority at the global level. It contributes to economic growth, empowers women economically and supports several Sustainable Development Goals, especially goal five on gender equality. The Global Findex in 2017 showed a gender gap of seven percent globally and nine percent in developing countries, with the COVID-19 pandemic expected to have done little to narrow this divide.

Women’s financial inclusion is a top priority at the global level. It contributes to economic growth, empowers women economically and supports several Sustainable Development Goals, especially goal five on gender equality. The Global Findex in 2017 showed a gender gap of seven percent globally and nine percent in developing countries, with the COVID-19 pandemic expected to have done little to narrow this divide.

Bank of Zambia and other key stakeholders in the country have spent years working towards greater financial inclusion and gender equality, in line with the Zambia Vison 2030 and a national blueprint for growth. These efforts have been integrated into the country’s first national financial inclusion strategy, which aims to halve the gender gap and increase women financial inclusion to 70 percent in 2022 from 30 percent in 2015.

This is aligned with the central bank’s commitment to AFI’s Denarau Action Plan, a living document that guides members within its network of financial sector regulators and policymakers towards taking action that promotes women’s access to quality and affordable financial services.

Conscious of the importance of having hard evidence to drive policy, Bank of Zambia began many years ago to consistently measure financial inclusion with a special focus on women. FinScope demand-side surveys in 2009, 2015 and 2020 have been able to capture important aspects of the gender gap and women’s financial inclusion evolution.

The results of these surveys have shown progress in reducing the gender gap, especially in 2020, partially explained by an increase in the use of mobile money. They also found that 58.5 percent of women are now financially included, compared to 33.3 percent in 2015. This reduced the gender gap in access to formal financial services to 5.8 percent in 2020 from 9.9 percent in 2015, demonstrating commendable progress despite the persistent global gap trend.

While demand-side surveys are a critical first step for setting up diagnostics in terms of women’s financial inclusion, they must be complemented by the analysis of administrative data from financial sector providers. Having data from the supply side and its segmentation by sex allows both policymakers and regulators to better understand more granular constraints, as well as trends and opportunities to promote women’s financial inclusion.

Through the execution of a grant received from AFI, funded by Data2X, the Bank of Zambia launched a two-year program in 2018 to develop a framework for collecting and using supply-side sex-disaggregated financial inclusion data for evidence-based and data-driven policymaking. Additional financial and technical support was provided by national organizations and programs, including Financial Sector Deepening Zambia and the Rural Finance Expansion Programme.

This process started with a peer learning knowledge exchange program involving regulators from other countries with experience in developing sex-disaggregated financial inclusion data. It also drew focus to a baseline study among Zambian financial service providers and regulators that covered data collection, gender segmentation, diversity and product focus to understand the data ecosystem and build buy-in from key stakeholders, including authorities, other regulators and the financial industry.

Through the program, Bank of Zambia garnered key insight on the sex-disaggregation of supply-side data, including the identification of inadequacies in terms of tailoring financial services to meet women’s specific needs, the advantages of women clients as committed savers and responsible borrowers, and the rapid adoption of digital financial services. It also underscored the practical importance of collecting sex-disaggregated data in a consistent and frequent manner.

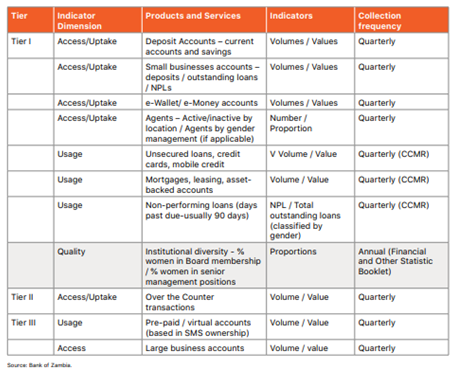

Table – Bank of Zambia Sex-Disaggregated Indicators

As a result, Bank of Zambia and other regulators successfully established new guidelines and adapted data reporting templates and systems to collect sex-disaggregated financial data more systematically. The central bank is now in the process of adopting an automated system to collect sex-disaggregated financial inclusion data from its reporting institutions on a more consistent and frequent basis and disseminate relevant aggregate market data. The automated data, in particular, is expected to help financial institutions identify market opportunities to tailor financial products and services to women and help champion institutional diversity and women’s leadership across the financial sector. We invite you to read the recently published Zambia Case Study, which describes the country’s gender data journey, and learn about key elements of success in contributing to a more gender-informed financial sector in Zambia.