We’ve known for a long time that the female economy represents a huge untapped opportunity for financial services providers.

And to prove it, every year we collect data from our global membership and publish it in our highly anticipated “Economics of Banking on Women” report.

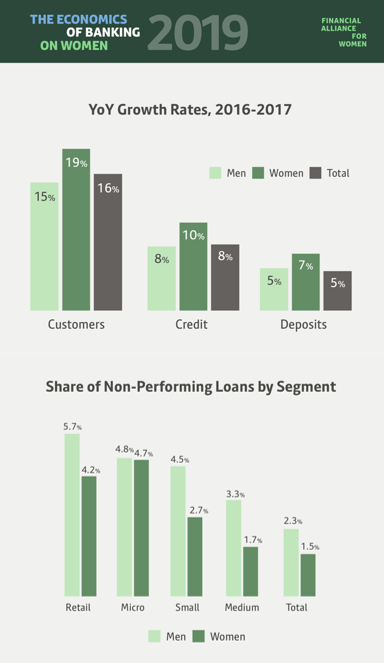

This year, just like in the last four years, our survey data shows that women are outpacing the overall market in terms of customer, credit, and deposit growth. They’re also paying back their loans at higher rates than men, and they have similar levels of products per customer, a good measure of engagement.

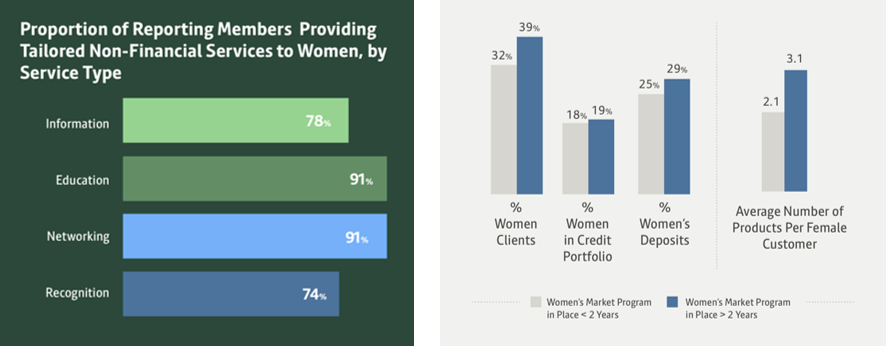

Alliance members — from regional financial institutions to large multinationals — recognize the value of the female economy and are working hard to create financial experiences tailored specifically to meet women’s needs, providing them with access to information, education, networking and recognition for their achievements, in addition to a wide range of financial solutions.

Our results demonstrate that members who have made championing the female economy a long-term strategy perform better with women. Organizations that have been actively engaging with women longer have a higher share of women customers. They also provide more credit and hold more savings, and their female customers buy more products from them.

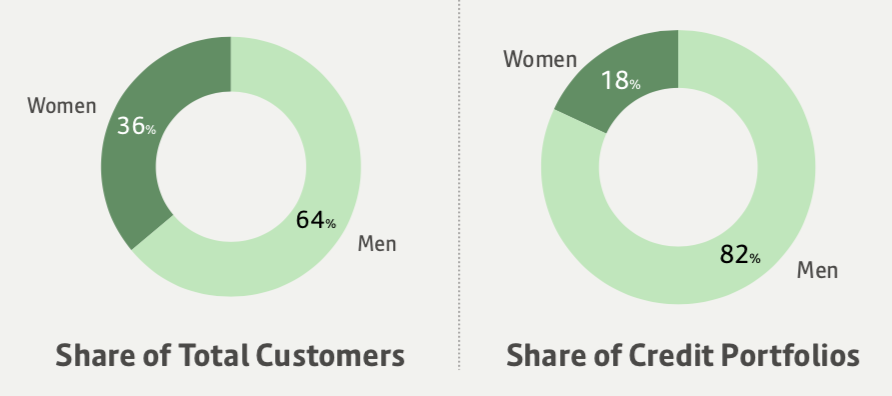

Yet even among our members, much work remains to be done: Women are still under-represented — both in terms of number of customers and credit portfolios.

This survey highlights the massive opportunity financial services providers have to grow their business by accelerating women’s financial power. And it’s only possible because our members understand the huge impact gender data has to help them paint an accurate picture of the female economy and develop effective women-centered strategies.

The power of this data is the focus of our Women’s Financial Inclusion Data (WFID) partnership, spearheaded by Data2X. To showcase just how financial services providers can and must use gender data to drive the female economy forward, WFID has convened the Data Driving Action for Women dialogue series across 2019.

Our latest event explored how institutions address their challenges around collecting gender data and how they’re using it to design solutions that better reach women. A key takeaway: No matter the asset level, gender-data challenges are similar across FSPs, including a lack of buy-in from senior management, legacy information and data management systems that make collecting data difficult, a lack of common definitions and concerns about data privacy.

Read the recap of the session for more information, including some solutions to these challenges. And download our full “Economics of Banking on Women” report for more insights and explanations.

Founded in 2000, the Financial Alliance for Women – formerly the Global Banking Alliance for Women – is the only global consortium of financial institutions dedicated to supporting one another as they seek to tap into the opportunity of the Women’s Market.